The Hidden Tax: How Poor Cybersecurity Is Silently Costing Your Company Millions

Cybersecurity isn't just an IT problem—it's a massive financial drain. Learn how vulnerabilities are secretly tanking your company's value and what you can do about it.

Posted by

Related reading

Vendor Contracts: Your Overlooked Cybersecurity Shield (or Weakness?)

Reliance on third-party vendors & AI tools introduces risks. Learn why strong contracts are crucial for cybersecurity and how to manage vendor risk effectively.

They're Going to Scam You: Understanding Modern Online Deception

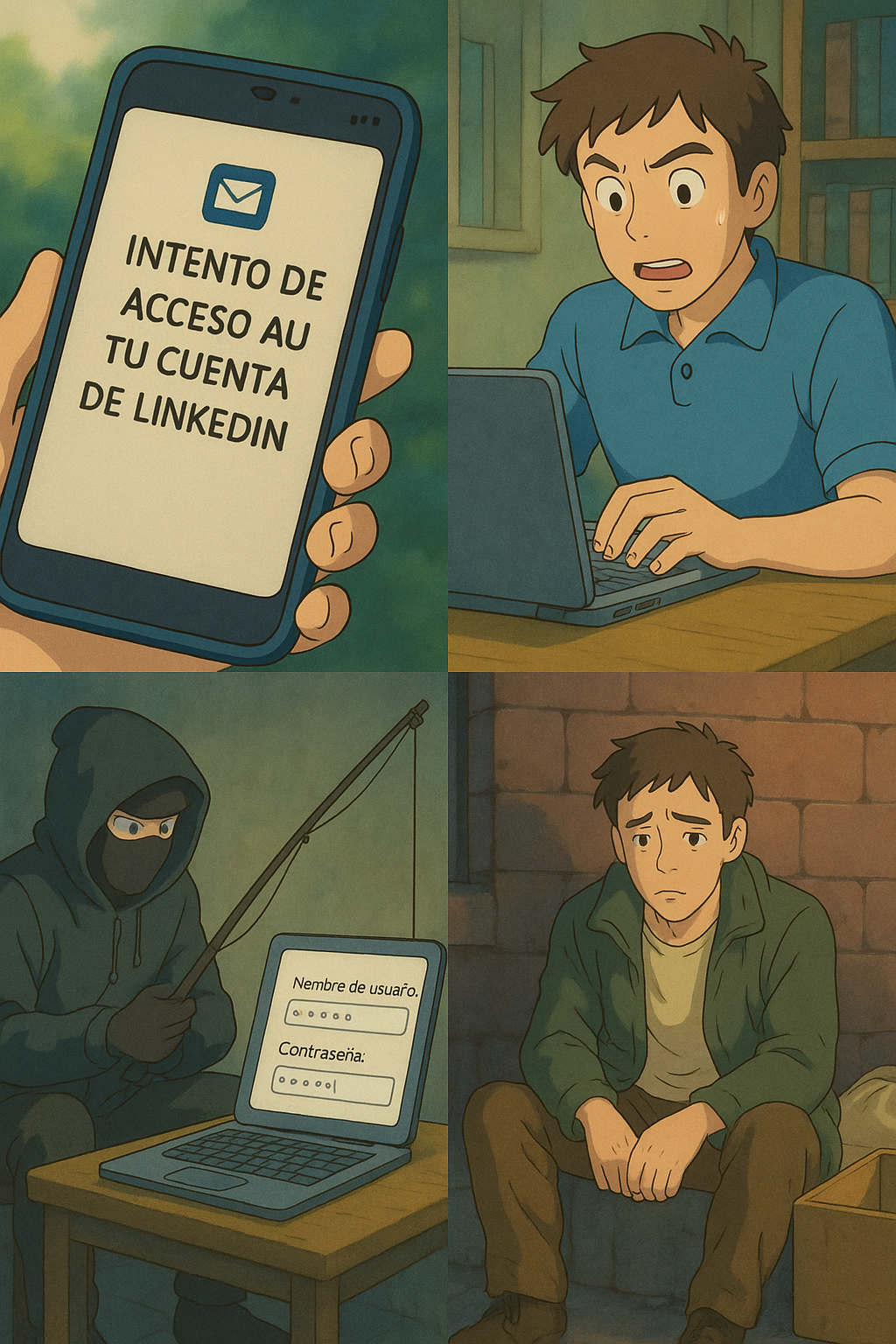

Online scammers are more sophisticated than ever. Learn about social engineering, phishing tactics, and how to protect yourself and your business from these evolving threats.

Why Marketing Agencies Are Prime Targets for Cyberattacks (And How to Protect Yours)

Marketing companies face unique cybersecurity risks. Learn why hackers target marketing agencies and discover key steps to protect your agency from cyberattacks.

The Hidden Tax Draining Your Company's Value

What if I told you there's a hidden 'tax' on your company, quietly siphoning off millions from your valuation? It's not from the government. It's the price you pay for every unpatched server, every open network port, every ignored vulnerability. For too long, we've treated cybersecurity as a technical problem for the IT department. Groundbreaking new research shows that's a financially catastrophic mistake.

Measuring the Invisible: Seeing Your Company's True Risk

Think of your company's digital presence like a house. Every open port is an unlocked window. Every piece of outdated software is a rusty lock. For years, we only talked about the houses that got burgled (i.e., suffered a public data breach). But now, researchers have figured out how to count every unlocked window and door across thousands of companies.

By scanning for these vulnerabilities directly, they've created a direct measure of a company's cyber risk. And what they found should be a massive wake-up call for every CEO, CFO, and board member.

The $87 Million Mistake

The data is clear: companies with more 'unlocked windows' consistently and significantly underperform in the stock market.

- These vulnerable companies see their stock returns lag by over 0.5% every single month compared to their more secure peers.

- That translates to a 5% underperformance annually. A silent tax on shareholder value.

- For a typical large company, this isn't pocket change. It's an average loss of $87 million in shareholder value. Poof. Gone. Wiped out by risks that were preventable.

And it gets worse. These are, unsurprisingly, the same companies far more likely to end up in the headlines for a devastating data breach. The risk isn't just theoretical; it's actively harming them.

From an investor's point of view, this new risk landscape is a minefield. How do you protect your portfolio when a company's biggest liability doesn't appear on its balance sheet? For self-directed investors looking to make better decisions in a complex economy, platforms like Diversification.com offer essential tools to analyze and help shield portfolios from these hidden, sector-specific risks.

Why Is This Happening? The Boardroom Blind Spot

How can companies let this happen? It boils down to two critical failures:

- 1. The Talent Chasm: There is a massive global shortage of qualified cybersecurity professionals. It's like trying to hire firefighters during a city-wide inferno; there simply aren't enough experts to go around to patch all the vulnerabilities.

- 2. Managerial Inattention: This is the bigger issue. A shocking 88% of corporate boards lack any meaningful cybersecurity expertise. Leadership treats cybersecurity like a plumbing problem to be delegated to IT, not as the fundamental strategic and financial risk it truly is. When the board isn't paying attention, security is not a priority.

Your Wake-Up Call: From IT Problem to Strategic Priority

You cannot wait for a breach to happen or for investors to finally notice the risk and punish your stock price. The time to act is now.

- Elevate Cybersecurity in the Boardroom: Your Chief Information Security Officer (CISO) needs real authority and a direct line to the board. Security must be a recurring agenda item.

- Measure What Matters: Start thinking like the researchers. What are your vulnerabilities? Where are your 'unlocked windows'? Proactive risk assessment is non-negotiable.

- Build a Human Firewall: Not all threats are technical; they exploit your people. Phishing, scams, and malicious files are the most common entry points. At NotJustVPN, we provide the tools to empower your team, making them your strongest line of defense.

By detecting threats before they can be exploited, you're not just preventing a data breach; you're protecting your company's financial health and shareholder value.